Page 14 - Singledebt

P. 14

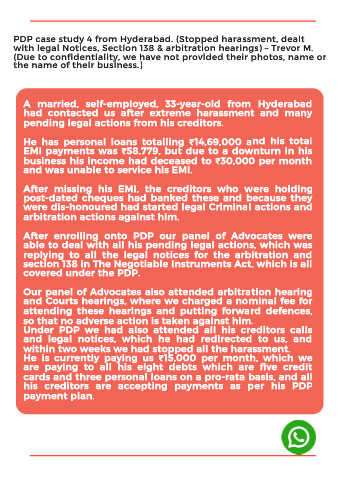

PDP case study 4 from Hyderabad. (Stopped harassment, dealt

with legal Notices, Section 138 & arbitration hearings) – Trevor M.

(Due to confidentiality, we have not provided their photos, name or

the name of their business.)

A married, self-employed, 33-year-old from Hyderabad

had contacted us after extreme harassment and many

pending legal actions from his creditors.

He has personal loans totalling ₹14,69,000 and his total

EMI payments was ₹58,779, but due to a downturn in his

business his income had deceased to ₹30,000 per month

and was unable to service his EMI.

After missing his EMI, the creditors who were holding

post-dated cheques had banked these and because they

were dis-honoured had started legal Criminal actions and

arbitration actions against him.

After enrolling onto PDP our panel of Advocates were

able to deal with all his pending legal actions, which was

replying to all the legal notices for the arbitration and

section 138 in The Negotiable Instruments Act, which is all

covered under the PDP.

Our panel of Advocates also attended arbitration hearing

and Courts hearings, where we charged a nominal fee for

attending these hearings and putting forward defences,

so that no adverse action is taken against him.

Under PDP we had also attended all his creditors calls

and legal notices, which he had redirected to us, and

within two weeks we had stopped all the harassment.

He is currently paying us ₹15,000 per month, which we

are paying to all his eight debts which are five credit

cards and three personal loans on a pro-rata basis, and all

his creditors are accepting payments as per his PDP

payment plan.