Page 12 - Singledebt

P. 12

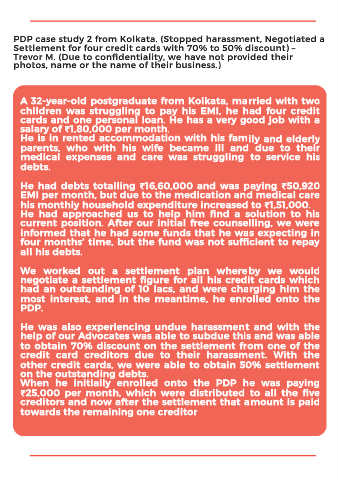

PDP case study 2 from Kolkata. (Stopped harassment, Negotiated a

Settlement for four credit cards with 70% to 50% discount) –

Trevor M. (Due to confidentiality, we have not provided their

photos, name or the name of their business.)

A 32-year-old postgraduate from Kolkata, married with two

children was struggling to pay his EMI, he had four credit

cards and one personal loan. He has a very good job with a

salary of ₹1,80,000 per month.

He is in rented accommodation with his family and elderly

parents, who with his wife became ill and due to their

medical expenses and care was struggling to service his

debts.

He had debts totalling ₹16,60,000 and was paying ₹50,920

EMI per month, but due to the medication and medical care

his monthly household expenditure increased to ₹1,51,000.

He had approached us to help him find a solution to his

current position. After our initial free counselling, we were

informed that he had some funds that he was expecting in

four months’ time, but the fund was not sufficient to repay

all his debts.

We worked out a settlement plan whereby we would

negotiate a settlement figure for all his credit cards which

had an outstanding of 10 lacs, and were charging him the

most interest, and in the meantime, he enrolled onto the

PDP.

He was also experiencing undue harassment and with the

help of our Advocates was able to subdue this and was able

to obtain 70% discount on the settlement from one of the

credit card creditors due to their harassment. With the

other credit cards, we were able to obtain 50% settlement

on the outstanding debts.

When he initially enrolled onto the PDP he was paying

₹25,000 per month, which were distributed to all the five

creditors and now after the settlement that amount is paid

towards the remaining one creditor